GCASH FEES 2025

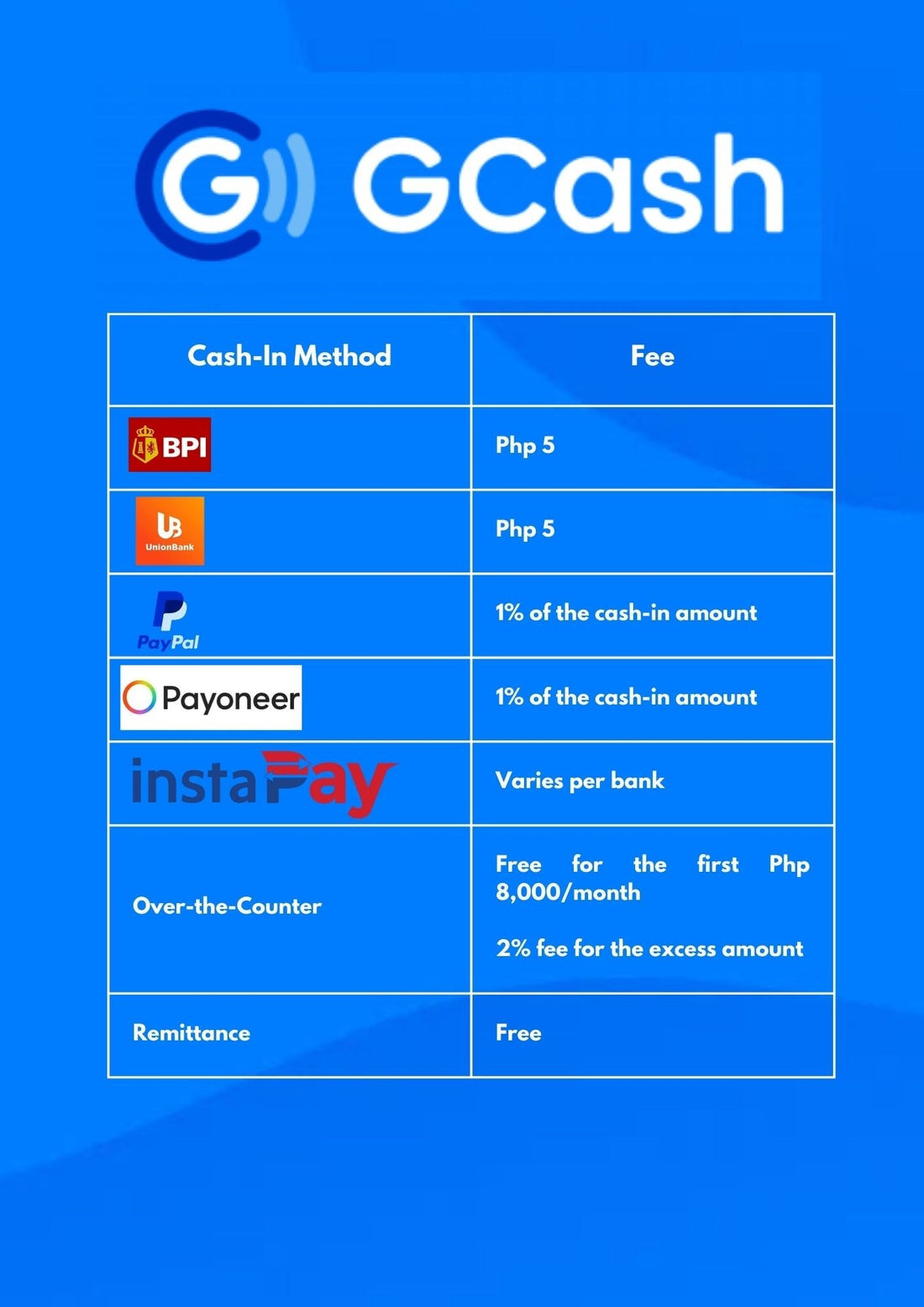

MANILA — Adding funds to your GCash wallet? Understanding the latest cash-in fees can help you manage your finances wisely. Here’s a breakdown of the charges across different methods:

Cash In via Linked Bank/Digital Wallet

- BPI & UnionBank: PHP 5 fee

- PayPal & Payoneer: 1% fee of the cash-in amount

Cash In via Online Banking (InstaPay)

- Available in over 40 partner banks

- Fees vary per bank, so check their charges before transferring funds.

Cash In via Over-the-Counter Transactions

- Free for the first PHP 8,000 per month

- 2% service fee for amounts exceeding PHP 8,000

Example: If you cash in PHP 9,000, the first PHP 8,000 is free, while the excess PHP 1,000 incurs a 2% charge (PHP 20). You’ll receive PHP 8,980.

Cash In via Remittance

- 100% FREE when using GCash partner remittance services.

Plan Your Cash-Ins Wisely

Stay updated with these fees to avoid unexpected charges and maximize your transactions. For further details, visit GCash’s official channels.